resOS requires a valid VAT number for business in the EU, in order to avoid having to pay 25% VAT. If you are experiencing issues validating the VAT number in resOS or you are curious about this subject, take a look below.

What is VAT?

VAT (Value-Added Tax), in the EU (European Union), is a general consumption-based taxed added to services and goods. You can read more about it here. You can also see here how different VAT numbers are formatted based on the country they are registered under.

Where to add my VAT number in resOS?

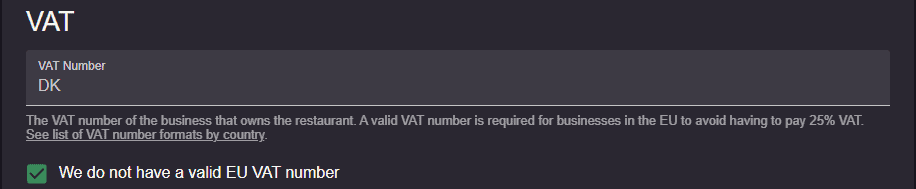

If you go to Menu–> Settings–> General –> Name & Contact, you can add your VAT number under the section called “VAT“. If you do not have a valid VAT number, please check the box “We do not have a valid EU VAT number” so that the system stops notifying you about this.

Why are my invoices not showing the VAT?

If you added your VAT number to the system and it is valid, then you won’t be charged VAT. Therefore, VAT will not show up on your invoices, it is only added if you do not have a valid VAT number or you check the box from above in the system. You can check out your invoices in the billing section.

Why is my VAT number validation saying invalid?

This is most likely because your VAT number isn’t registered for intra-community trade. When you represent a business based in the European Union and you want to use resOS, then you need to be registered for intra-community trade. If you haven’t done this, then you will have to pay 25% VAT on top of your subscription package.

In most of the countries within the EU, a company is normally registered for intra-community trade immediately once creating a VAT number. This is, however, not the case for all countries, and we are aware of the fact that businesses from Spain, Italy & Portugal has to make this registration separately.

What do I do if the system shows that my VAT number as invalid?

In this case, please contact your local tax or VAT office and register your current VAT number for intra-community trade.

Why and how do we check & verify your VAT number in VIES?

Businesses that are registered for EU intra-community trade will be shown in VIES (VAT Information Exchange System). We will compare and verify your VAT number in your resOS account with the VIES.

You can use this service to check if you are eligible for intra-community trade: https://www.valdit.com/en-gb. If you have a VAT numbers (you are classified as a business), according to the law, we are required to verify your number before we create your invoices.

If you have further questions regarding VAT and resOS, please reach out to our our support team at [email protected]. They would love to help and offer more information if needed!